Lots at Less offers different types of customs clearance services depending on the country of import:

Customs/Import Duties and Taxes Unpaid:

- Postpaid Duties and Taxes: Customers do not pay duties and taxes to Lots at Less at the time of order.

- Carrier Settlement: Charges are settled directly by the customer with the carrier for customs release.

- Invoice from Shipping Company: Customers will receive an invoice from the shipping company covering customs duty, import taxes, and other expenses.

- Receipt for Future Reference: Customers should keep the receipt of the customs payment for future reference.

- Responsibility for Charges: Customers are responsible only for paying customs duty and other charges at the time of clearance. If additional charges are requested at delivery, contact our customer service immediately.

Customs/Import Duties and Taxes Paid:

- Prepaid Duties and Taxes: Customers pay the duties and taxes in advance to Lots at Less when placing their order.

- No Additional Charges: No extra charges will be incurred by the customer after the initial payment.

- Required Documentation: If any documents are needed from the customer, they must be provided promptly.

Calculating Customs/Import Duties and Taxes:

- Estimation at Checkout: Customs/import duties and taxes fees displayed at checkout are estimates, not exact calculations.

- Actual Fees: If actual customs fees exceed the estimated fees paid at the time of order, Lots at Less will cover the additional charges.

- Replacement Shipments: These terms also apply to any replacement product shipments, if applicable.

Factors Influencing Customs/Import Duties and Taxes:

- Product Category and Price: The type and cost of the product.

- Shipping Costs and Package Weight: The cost and weight of the shipment.

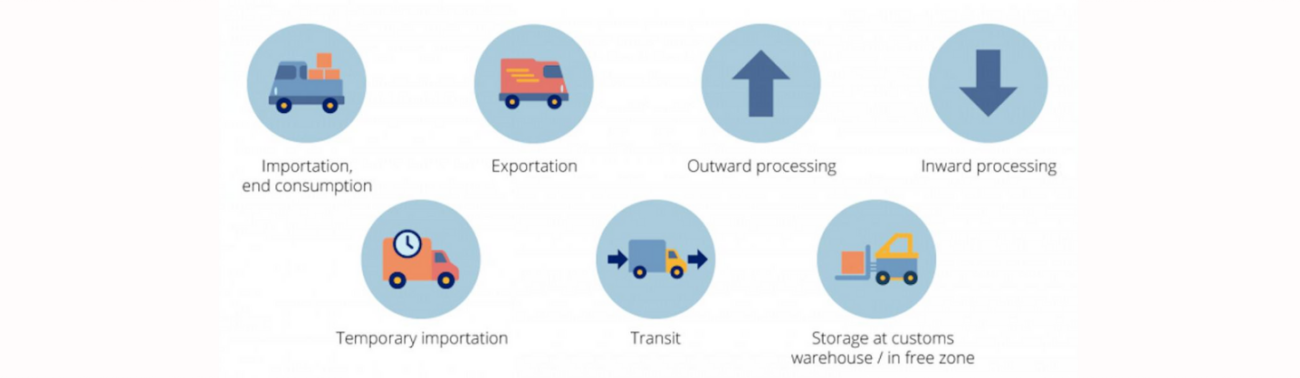

- Customs Clearance Channel: The specific customs clearance process used.

- Storage Charges: These may apply if there is a delay in submitting required paperwork.

- Import Taxes: Based on the custom duty amounts.

- Destination Country Rules: Import fees as per the customs regulations of the destination country.

- Multiple Shipments: For orders split into multiple shipments, customs charges will apply to each shipment accordingly.